Spending Update 2024 |

April 16th, 2024 |

| ea, money |

This post uses the same approach as last year, which is almost the same as before then. Numbers are monthly, based on 2023 spending:

- Donations: $6.2k (48% of 2023 adjusted gross income)

- Taxes: $3.4k

- Income tax: $1k

- State tax: $400

- Social Security tax: $900

- Medicare tax: $200

- Property tax: $800

- Childcare: $4.3k ($200/workday, three kids)

- Housing: $2.7k

- Note: this is tricky; see details below on how this is calculated

- One time expenses (all time)

- Purchase and all one-time expenses up through the 2022 update: $1.1M

- Major one-time expenses since the 2022 update: $19.4k:

- Bathroom renovation: $14.5k

- Porch roof replacement: $1.5k

- Replacement fridge: $1.8k

- Shower leak: $1.6k

- Ongoing expenses, covering the whole house including the tenants' unit:

- Electricity: $271

- Gas (Heat): $202

- Water/Sewer: $165

- Other: $165

- Rent income: $4.1k

- Retirement saving: $3.7k (all pre-tax)

- Other savings: -$6.4k (see below)

- Medical: $244 in pre-tax health insurance, ~$400 in post-tax co-pays etc

- Food: $732 (two adults, two kids, one toddler)

- Other: $1k

- Includes phone bills, taxis, car rentals, clothes, vacation, stuff for the kids, and other smaller expenses.

- Because we are no longer tracking our expenses to the dollar, the distinction between "Other" and "Savings" is an estimate.

Here's a summary of our monthly spending as a table:

| Category | pre-tax | post-tax | total |

|---|---|---|---|

| Donations | $0 | $6,167 | $6,167 |

| Taxes | $0 | $3,400 | $3,400 |

| Housing | $0 | $2,793 | $2,793 |

| Childcare | $0 | $4,275 | $4,275 |

| Medical | $244 | $400 | $644 |

| Food | $0 | $732 | $732 |

| Other | $0 | $1,000 | $1,000 |

| Savings | $3,750 | -$6,000 | -$2,250 |

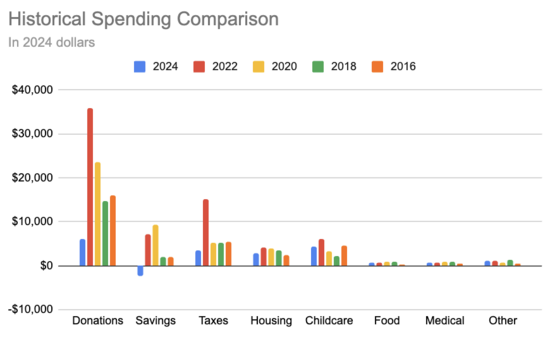

Comparing to previous years and adjusting for inflation, still monthly:

| 2024 | 2022 | 2020 | 2018 | 2016 | |

|---|---|---|---|---|---|

| Donations | $6,167 | $35,870 | $23,614 | $14,750 | $16,053 |

| Savings | -$2,250 | $7,065 | $9,277 | $1,875 | $1,974 |

| Taxes | $3,400 | $15,217 | $5,301 | $5,188 | $5,447 |

| Housing | $2,793 | $4,022 | $3,892 | $3,438 | $2,461 |

| Childcare | $4,275 | $5,978 | $3,313 | $2,125 | $4,566 |

| Food | $732 | $748 | $904 | $938 | $303 |

| Medical | $644 | $773 | $784 | $933 | $417 |

| Other | $1,000 | $1,087 | $602 | $1,400 | $388 |

Here's this as a chart:

The biggest changes with 2024 are:

Donations are down a lot, because our income is down a lot. We're still going for 50%, though I'm still unsure whether this makes sense given that our workplaces are both altruistically funded.

-

Savings are down a lot, showing up as negative above. A lot of this is an effect of the amortized approach I'm using for the housing accounting (more). Above I have our housing as $2,800/month, but a lot of that was effectively pre-paid through the downpayment, dormers, mercury spill, solar, heating upgrades, etc. and at the time was counted as 'saving'. While we did spend $14.5k on gut-renovating the first floor bathroom, that's the only really big expense in the last two years: our house expenses have slowed down a lot. And we refinanced in 2021, spreading our remaining payments out over another 30y and dropping our rate from 4% to 3.375%.

All together, if you just look at it on a cashflow basis (how much money left our bank account to deal with housing less how much came back in as rent) over the past two years we've averaged spending of -$442/month. That is, we've brought in enough from rent to cover the portion of our housing that we didn't pre-pay, with a bit left over. This is enough that, on a cashflow basis, we're not spending down our savings and are actually saving a small amount of money.

This all feels awfully messy, but I guess handling this kind of complexity is why accounting is a profession.

-

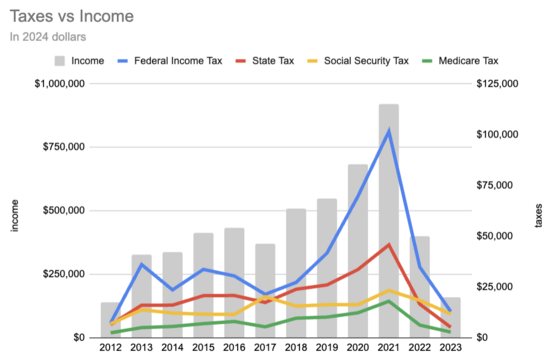

Taxes are much lower. A more detailed view:

Most of what's going on is that we're earning much less money, and so pay less in tax. Our income tax was maybe $5k higher this year than it should have been because half our 2023 donations ended up formally in 2024. It's also interesting that Social Security tax is now a much greater proportion: this is because it's 6.2% of wages up to contribution and benefit base, which was $160k in 2023. Since it's only linear up to that cap, and for many years I was earning more than the cap, it's grown as a fraction of our taxes.

Housing is down a bit because rent has increased (partly Boston getting more expensive, partly renovating and renting out the backyard office).

Childcare is down a bit because we're now doing a nanny share. While the rates we're paying are a bit higher than the end-of-2021 numbers I used last time, each family now pays 2/3 of what they would pay if the nanny were watching only that family's children.

This is the first time I've included inflation in one of these posts, through a combination of it having a larger effect than before and my previously being too lazy to include it.

When I write this post in 2026, what do I expect to be saying?

I think there's a good chance we'll have switched from giving 50% to some form of salary sacrifice. If we do, our pay, donations, and taxes will all be a lot lower.

Childcare should be similar: the nanny share is working and I expect we'll do something similar at least until our youngest starts kindergarten in Fall 2026 (and will show up in the 2028 update).

I'd like to hope I have a better way of accounting for housing and savings in general and have gone back and redone all my previous numbers under the new system, but since that sounds like a ton of work I doubt I'll have done that.

I put about a 10% chance on AI, war, or other major events in this timeframe changing things enough that everything is weird in hard to predict ways.

Comment via: facebook, lesswrong, mastodon, substack