Spending Update 2020 |

August 17th, 2020 |

| money |

For past updates I've generally presented averages over a time period, but instead here I want to try more of a snapshot approach. This is my best estimate of what we're spending now, informed by our recent spending. As housing continues to be a complicated topic, I've used the same amortized approach as last time (see footnote 1 there).

Another difference from last time is that this time I'm thinking more about how there are kind of two different total incomes that makes sense to consider:

Our Adjusted Gross Income (AGI): how much money does the IRS think we make. This is what we use for figuring out how much to donate, and the IRS is reasonably invested in making it a good definition of income.

The total amount of money that we, in a sense, direct. This includes our AGI, but it also includes our paycheck deductions for health insurance, retirement, etc. Unlike, say, the portion of our paychecks that is deducted for Social Security Tax, the IRS doesn't consider this money to be part of our income.

In the past I haven't thought clearly about this, but this time I'm going to try to run the numbers both ways. Below when I describe an amount as "pre-AGI", I mean that it's from one of these paycheck deductions. I'm not including amounts my employer pays, though there's a sense in which this is arbitrary. If the total cost of our family's healthcare is $30k, and my employer switches from covering 100% to covering 50% and rases compensation by $15k to match, should this be showing up in my numbers here? Accounting is tricky.

Anyway, here are the monthly numbers:

- Donations: $19,600 (53% of 2019 adjusted gross income)

- Retirement saving: $4,500 ($1.6k pre-AGI, the rest is after-tax 401k contributions)

- Taxes: $4,400

- Income tax: $2.8k

- State tax: $1.8k

- Social Security tax: $1.1k

- Medicare tax: $0.7k

- Housing: $3,230

- One time expenses (all time)

- Purchase and all one-time expenses included last time: $1,047k

- Replacing the second floor bathroom: $26k

- 5KW of rooftop solar: $18k

- Ongoing expenses, all whole-house (including tenants' unit):

- Other: $250

- Electricity: $190

- Water/Sewer: $85

- Gas (Heat): $135

- Rent income: $3.4k

- One time expenses (all time)

- Savings: $3,200

- Childcare: $2,750 ($132/workday, two kids; $415 pre-AGI)

- Medical: $1,280 (all pre-AGI)

- Food: $750 ($250/adult, $150/person)

- Other: $500

- Includes phone bills, taxis, car rentals, clothes, vacation, stuff for the kids, and other smaller expenses.

- Because we are no longer tracking our expenses to the dollar, the distinction between "Other" and "Savings" is an estimate.

In table form:

| Category | pre-AGI | post-AGI | total |

|---|---|---|---|

| Donations | $0 | $19,600 | $19,600 |

| Retirement | $1,600 | $2,900 | $4,500 |

| Taxes | $0 | $4,400 | $4,400 |

| Housing | $0 | $3,230 | $3,230 |

| Savings | $0 | $3,200 | $3,200 |

| Childcare | $415 | $2,335 | $2,750 |

| Medical | $1,280 | 0 | $1,280 |

| Food | $0 | $750 | $750 |

| Other | $0 | $500 | $500 |

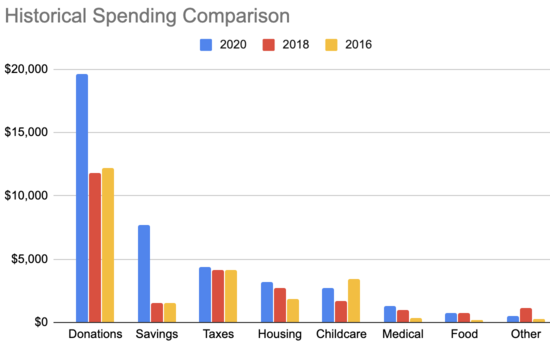

Comparing to the last three updates:

| 2020 | 2018 | 2016 | |

|---|---|---|---|

| Donations | $19,600 | $11,800 | $12,200 |

| Savings | $7,700 | $1,500 | $1,500 |

| Taxes | $4,400 | $4,150 | $4,140 |

| Housing | $3,230 | $2,750 | $1,870 |

| Childcare | $2,750 | $1,700 | $3,470 |

| Medical | $1,280 | $950 | $370 |

| Food | $750 | $750 | $230 |

| Other | $500 | $1,120 | $295 |

Changes:

Our income is up substantially, which has gone half to donations and half to savings (including retirement accounts).

Despite the increase in income, our taxes are only slightly higher. This is due to charitable deductions and tax cuts.

Our house is getting closer to how we want it, and so we have fewer major house projects. Because I've amortized our house projects over thirty years, however, this still shows up as a small increase in housing spending. A bigger factor is that while we're still renting out unit one we now only have one housemate with us in unit two, which means we collect less in rent and so our effective housing cost is up.

We're paying more for childcare than last time, because of a January 2020 ruling that changed how Au Pair wages work.

See the 2018 post for discussion of changes from 2016 to 2018.

Comment via: facebook, lesswrong, substack