Rents Are High, But Not Skyrocketing |

January 8th, 2026 |

| housing, money, rent |

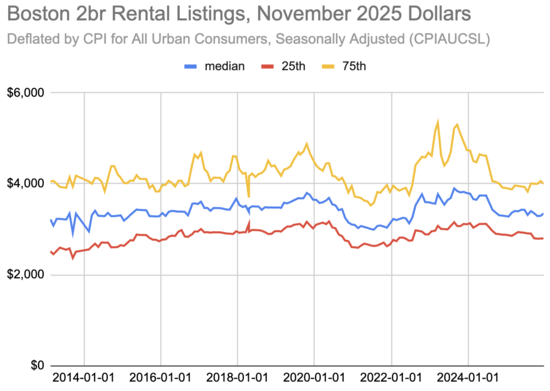

Here's the data I know best, the price of a 2br that I calculate on my Boston Rent Map:

The median Boston-Area rent in December 2025 was $3,350. That's up from $2,300 in February 2013, or $3,215 in current dollars. Rent has gone up, but just about matching inflation.

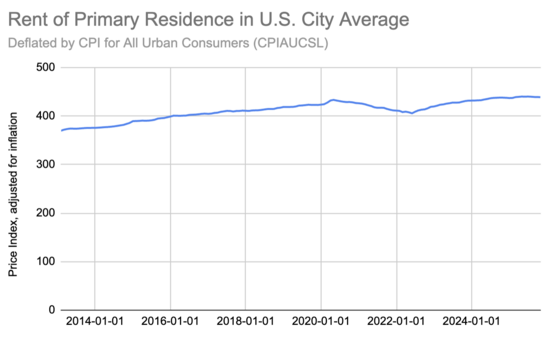

I see the same thing nationally. Here's the Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average (CUSR0000SEHA), adjusted for inflation:

Rent needs to go down, and I'm very supportive of efforts to remove supply restrictions so landlords can stop making windfall profits. But it's important to be clear-eyed about what the issue is: rent has gone up a lot in places where there are the most jobs, then then it has stayed high for the last decade plus.

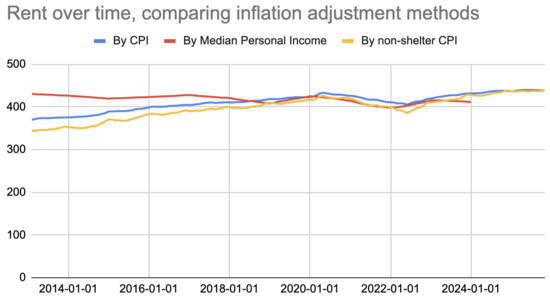

EDIT: people have asked if this is still true if we exclude the cost of housing from the determination of inflation (since otherwise it's partly circular) or if we compare the cost of housing to median income (to better capture affordability). This doesn't end up changing the picture much: excluding shelter from inflation pushes costs up a little; comparing to income pushes costs down a little.

Comment via: facebook, lesswrong, mastodon, bluesky