How Might a Country Leave the Eurozone? |

October 21st, 2011 |

| econ |

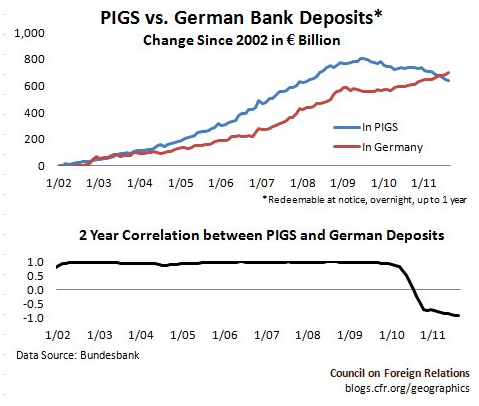

A simple answer might be "you close all banks, relabel everything (deposits, debts, salaries) in the new currency, print a bunch of money in a hurry [1], and open again as soon as possible". Then you end up with a currency that can start falling against the euro until your country is competitive again. In fact, a fear of this is leading to a "silent bank run" where people in greece are withdrawing their euros to store in safe deposit boxes or german banks:

People also have debts to foreign banks. Say I'm in greece and we use this plan. I am suddenly getting paid in drachmas which have fallen against the euro, but most of the stuff I want to buy is cheaper too, so I'm ok. Except that debt for things I bought in the past and still owe foreign banks for becomes even more difficult to keep up with.

There's also the issue of government debt. Would a departing portugal just claim that the debt it owed is now in escudos? Would they default on their debt entirely? (Which seems to have gone ok for argentina)

There may not be any good solutions. Perhaps by joining the eurozone countries gave up this freedom for good. But if you don't believe this, and think you know how a country might switch from the euro, your answer could win you $400K. The prize rules require the proposal to be entered by the end of january and address:

- Whether and how to redenominate sovereign debt, private savings, and domestic mortgages in the departing nations.

- Whether and how international contracts denominated in euros might be altered, if one party to the contract is based in a member state which leaves EMU.

- The effects on the stability of the banking system.

- The link between exit from EMU and sovereign debt restructuring.

- How to manage the macroeconomic effects of exit, including devaluation, inflation, confidence, and effects on debts.

- Different timetables and approaches to transition (e.g. "surprise" redenomination versus signalled transitions).

- How best to manage the legal and institutional implications.

- A consideration of evidence from relevant historical examples (e.g. the end of various currency pegs and previous monetary unions).

Can you solve this puzzle?

[1] That's impractical to do on short notice, so either you've

prepared new money (very quietly) in advance, or you could try just

taking euros and putting a special stamp on them (though then your

currency can only go down against the euro).

Comment via: google plus, facebook, substack