The MA Estate Tax is Broken |

September 24th, 2019 |

| money, tax |

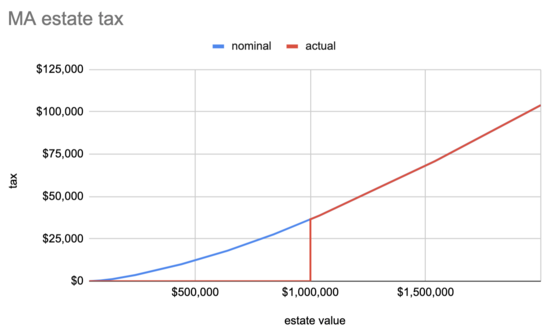

Nominally, it's a graduated system. Let's say when you die your only possession a big pile of cash. If it's $100k then you pay 0% on your first $40k, 0.8% on your next $50k, and then 1.6% on the rest, for a total of $200 (0.6%). It ramps up to eventually reach a marginal rate of 16% at $10M.

Except if your big pile of cash is under $1M, you're not required to file at all, and you actually pay $0. What you pay looks like:

You can see that someone dying with $1,000,001 is paying $37k, while someone dying with $999,999 is paying $0.

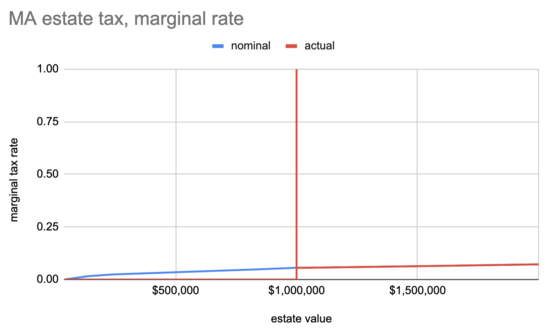

Here's the marginal tax rate, what you pay per dollar you die with:

That peak isn't 100%, though, it's 3,700,000%. Your millionth dollar sure costs you!

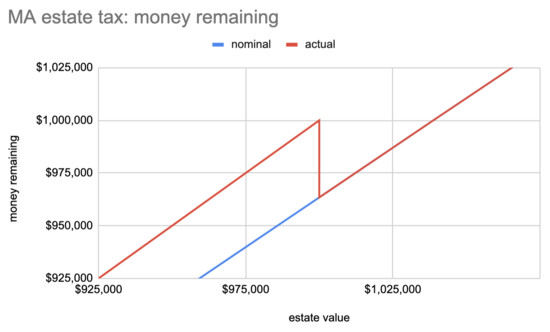

Here's another way of looking at it: $1M gives $963k after tax, which is the same amount you'd get if you'd just started with $963k.

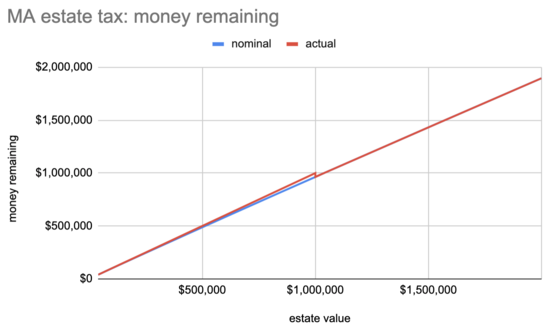

While $37k is a lot of money, it's still only 3.7% of $1M, so it's a barely noticeable blip if you look at it with some perspective:

Still, this does lead people to do weird things around the $1M mark, so a better system would just be to give each person a $1M exemption and then charge higher rates on estates over $1M to keep it revenue neutral. If you die with less than $1M you don't have to file, but also wouldn't owe any tax if you did.

(This doesn't get into the various ways that richer people and people with better planning can set up their finances so they avoid estate taxes, countering a lot of the intentional progressive setup. And it also doesn't get into additional complications around situations where you have to file despite having a net value of under $1M.)

Comment via: facebook, lesswrong, substack